What bank owns Allpoint ATMs?

Allpoint Network is owned and operated by NCR Atleos.

| Operating area | United States, Canada, Mexico, United Kingdom, Australia, and New Zealand |

|---|---|

| Members | ±1,100 |

| ATMs | Over 230,000 |

| Founded | 2003 |

| Owner | NCR Atleos |

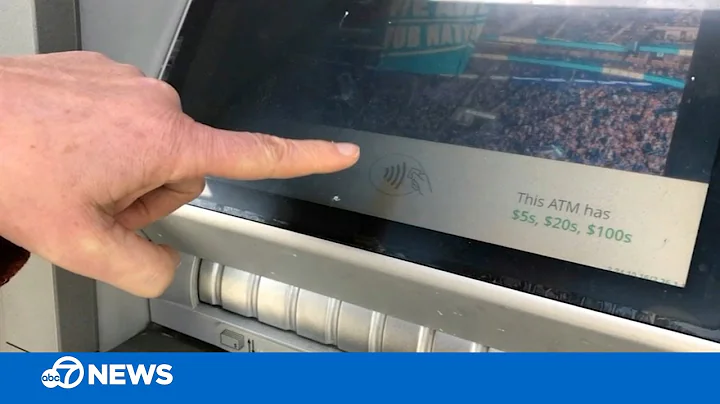

MoneyPass® and Allpoint® are Capital One partner ATMs, which means they're fee-free for Capital One checking customers to make withdrawals—woo-hoo! Wondering how to recognize them? They may not have the Capital One logo, so look for MoneyPass® or Allpoint® on the ATM.

With the Allpoint Network, give customers access to surcharge-free cash at over 40,000 locations in the U.S. and 55,000 globally—a network that surpasses the top three U.S. banks combined.

Get Cash.

Allpoint ATMs are located in leading national and regional merchant locations such as CVS, Target and Walgreens across the United States, Canada, Mexico, United Kingdom and Australia. Look for the green Allpoint logo on ATMs at participating locations.

The correct answer is White Label ATMs. White Label ATM: ATMs set up, owned, and operated by non-banks are called white label ATMs. They are authorized under the Payment and Settlement Systems Act, 2007, by the Reserve Bank of India.

Number of ATMs Percentage

The largest non-bank ATM provider in the U.S. is Cardtronics, with in excess of 100,000 ATMs deployed in America, and the second largest U.S. independent ATM provider is Payment Alliance International, with over 70,000 ATMs in service.

GET CASH AT OUR NO-FEE ATMS

Get cash from your checking account at one of our 70,000+ Capital One, MoneyPass® and Allpoint® ATMs near you.

Capital One is a subsidiary of Capital One Financial Corporation, a U.S.-based bank holding company headquartered in McLean, Virginia and founded in 1994. Capital One has been a subsidiary of Capital One Financial Corporation since it was established as a separate division of the company in 1994.

The amount can vary between Allpoint locations, but most will allow you to withdraw between $200 and $400 in a single transaction.

How do Allpoint ATMs make money?

Allpoint makes money via participating networks, not customers, you may still incur costs from your bank or card issuer (especially when converting currency), we recommend Allpoint ATMs, especially when used with a card that charges no withdrawal fees of its own.

Allpoint does not limit the number of transactions that can be done a day. Your card provider does have a daily ATM withdrawal amount limit.

Find in-network ATMs

An ATM owned by your bank or credit union, or one that's within the bank's partnered ATM network (such as Allpoint or MoneyPass), won't charge the out-of-network fee. To find an in-network ATM, try using an ATM locator on your bank's mobile app or its website.

Allpoint has put surcharge-free cash on nearly every corner, but until now, deposits have typically required a branch visit. Even for cardholders who prefer mobile check deposit, cash deposits still require a dedicated device or teller visit. Allpoint+ ramps up convenience, greatly enhancing deposit location density.

What is Chime's ATM Network? Chime has a large network of fee-free ATMs1 for Chime members. Get fee-free transactions at any MoneyPass ATM in a 7-Eleven location and at any Allpoint or Visa Plus Alliance ATM. To find a fee-free ATM near you, download the Chime mobile app and use the ATM Finder.

Can you deposit cash at an ATM that isn't your bank? Most banks don't allow you to deposit cash at an ATM that's out-of-network. The banks that do accept cash deposits through out-of-network ATMs often charge an extra fee — and, typically, require longer processing periods.

Proud to be the Largest Privately Owned Bank in the United States. MidFirst Bank is the largest privately owned bank in the United States with $36.7 billion in assets.

STAR is an American interbank network. It is the largest interbank network in United States, with 2 million ATMs, 134 million cardholders and over 5,700 participating financial institutions.

ATMs set up, owned and operated by non-banks are called WLAs. Non-bank ATM operators are authorised under the Payment & Settlement Systems Act, 2007 by the RBI. They provide banking services to customers using debit/credit/prepaid cards issued by banks.

The HALO II is the best selling ATM in the industry. This ATM provides the best value of any retail cash dispenser with added peace-of-mind from enhanced security features at an affordable price. This member of the Nautilus Hyosung retail family offers an improved UL 291 business hours safe with added...

What is the largest ATM withdrawal allowed?

Daily withdrawal limits typically range from $300 to $5,000 with most limits falling between $500 and $3,000. Your individual daily withdrawal limit usually resets the following day. However,be aware that, in some cases, daily limits are determined by a 24-hour period instead of a calendar day.

top atm manufacturers. When the time comes to select an ATM manufacturer, you'll find there are many companies that provide automated teller machine products and services. However, the top three ATM manufacturers that have proven their expertise and reliability with our team are NCR, Diebold Nixdorf, and Hyosung.

No, Walgreens ATM is not free for Cash App. When using a Walgreens ATM with your Cash App, you will incur the $2.50 fee charged by Cash App, and there may be an additional fee imposed by the ATM operator.

You can withdraw funds from your balance at no cost when using a MoneyPass ® ATM within the U.S. Find MoneyPass ATMs.

Capital One was named best big bank and best bank for ATM access as part of the 2024 Bankrate Awards, which recognizes the best financial products available to consumers.