Is it smart to link bank accounts?

Linking bank accounts enables you to transfer funds between two accounts. Having linked accounts can prove useful when you want to pay bills or add money to your savings. To help ensure it's safe to link your accounts, banks use measures such as encrypting data and requiring users to verify their identity.

One reason it's safe to link bank accounts is that banks use the highest level of cybersecurity available. These security measures range from a transport security layer that encrypts data sent over the internet to multi-factor authentication requiring you to verify your identity through multiple channels.

Tying the knot means making some decisions with your spouse about money. As you embark on your new life together, merging bank accounts might make sense if you're planning to share responsibility for bills, pool your savings and otherwise tackle finances as a team.

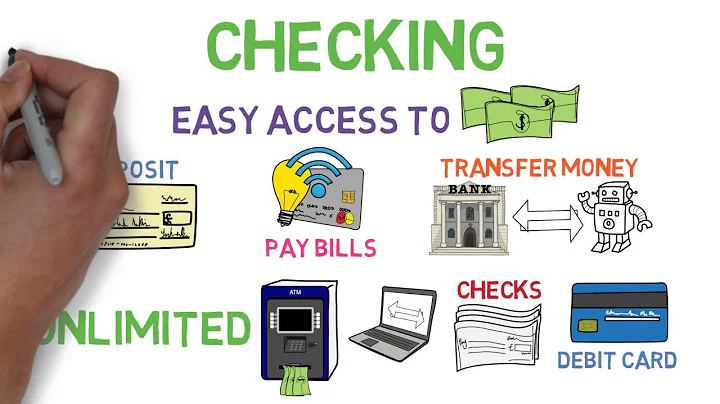

It can be beneficial to have multiple bank accounts. At minimum, it's a good idea to have a checking account (for your spending money and for paying bills) and a savings account. If you want to save for the short term and the long term, or have different savings goals, consider setting up multiple savings accounts.

Linking bank accounts is generally safe, but any integrations between third-party apps can leave you open to fraud or data breaches. While your bank will do what it can to keep you safe, this is not always enough.

Equal Responsibility: A joint banking account puts all co-owners on the hook for any overdrafts or issues associated with the account. This means the account assets are open for seizing to creditors, liens, and lawsuits if other co-owners get into financial or legal troubles.

If you have more than $250,000 in your bank accounts, any money over that amount could be at risk if your bank fails. However, splitting your balance between savings accounts at different banks ensures that excess deposits are kept safe, since each bank has its own insurance limit.

Checking accounts, including joint accounts, are not part of your credit history, so they do not impact credit scores. Your credit report only includes information about your debts, and accounts have the same effect on your credit whether you are associated with the account as an individual or as a joint owner.

| Pros | Cons |

|---|---|

| More transparency about spending habits | Lack of financial autonomy and privacy |

| Easier to budget shared income | Both partners have to account for each other's spending |

Ask financial planners about the benefits of joint checking accounts, and they will likely point out that shared accounts foster communication and trust. In order to manage money together successfully, couples must be open about their financial wants, worries and goals.

How many bank accounts is too much?

Depending on your financial goals, you may find that having more than one bank account makes sense. But there's no correct number of bank accounts to have. The key is figuring out which combination of accounts makes for the ideal match between your financial goals and your lifestyle.

Some billionaires may have accounts at multiple banks for diversification and security reasons, while others may consolidate their accounts into one or a few banks for simplicity and ease of management. It's also important to note that not all billionaires may keep their wealth in traditional banks.

Drawbacks of Having Multiple Bank Accounts

Fees: It's possible to find several bank accounts that don't charge monthly fees, but if you decide to choose banks or credit unions that charge them, it can get expensive fast. Organization: It's important to stay organized if you have more than one bank account.

By linking your savings and checking accounts, you can use your savings as a backup for overdraft protection. That means funds can automatically transfer from your savings to a checking account to cover a transaction that would otherwise overdraw your account and incur an overdraft fee.

Mobile banking or any other activity that exposes your sensitive data should never be done on public Wi-Fi. If a hacker is monitoring the public Wi-Fi or hotspot you are using, they could potentially intercept the data being transferred to and from your phone and use it to access your banking account.

Banks typically do not have direct access to information about a customer's accounts at other financial institutions. However, they may be able to obtain information about your other accounts through various means such as a credit report, if you give them permission to do so, or through a court order.

Joint Bank Account Rules on Death

"The joint owner becomes the legal and equitable owner of all funds in a joint account at the instant of death," says Doehring. "It does not become part of the probate estate."

Cons of joint bank accounts:

Potential money spats: While some couples thrive with the transparency of joint accounts, others do not. If all of your money comes from one pot, you might feel the need to discuss each item you buy with your partner.

| Company | Minimum Deposit | ATM Access |

|---|---|---|

| Ally Bank Best Overall | None | Nationwide but no cash deposits |

| Capital One Best for Parents & Teens | None | Nationwide |

| Axos Bank Best for Frequent ATM Users | None | Nationwide |

| Wells Fargo Best for Branch Banking | $25 | Nationwide |

Keeping all of your money at one bank can be convenient and is generally safe. However, if your account balances exceed the deposit limit that's insured by the FDIC, some of your money may not be protected if the bank fails. And if you're a fraud victim, having cash all in one place could compromise more of your money.

How much money should you keep in one bank?

For the emergency stash, most financial experts set an ambitious goal at the equivalent of six months of income. A regular savings account is "liquid." That is, your money is safe and you can access it at any time without a penalty and with no risk of a loss of your principal.

The FDIC insures up to $250,000 per account holder, insured bank and ownership category in the event of bank failure. If you have more than $250,000 in the bank, or you're approaching that amount, you may want to structure your accounts to make sure your funds are covered.

The researchers found that people who had merged bank accounts with their partner experienced a deeper sense of aligned financial goals and stronger communal norm adherence. Previous research by Finkel shows that couples who adopt stronger communal norms tend to be happier in their marriages.

Everyone named on the account has equal access to the joint bank account, but also equal responsibility. This can make it easier to manage shared bills such as rent, mortgage repayments or utility bills, but may also give you less control of the money leaving the account.

When a married couple opens a joint account together, they both have equal access to funds without each other's consent. Regular bank accounts, on the other hand, are owned by one person who has complete control over the account. Only the account holder can authorize transactions to and from that account.